Beyond Bootstrapping: Clever Funding Hacks for Early Stage Startups

- StartaSprout Team

- Dec 13, 2023

- 2 min read

Updated: Jan 4, 2024

Conventional wisdom insists bootstrapping with personal funds is the best (or only) option for cash-strapped founders initially financing their startups. But solely relying on your own reserves or credit cards stifles innovation and growth.

The reality is that bootstrapping alone hamstrings most startups in their infancy. Multiple creative funding strategies exist beyond just your own savings that offer capital without requiring large personal sacrifices or impossible future returns for investors.

Here are 6 funding hacks to fuel your startup’s early stages:

Pitch Competitions

Seeking small injections of capital in the early days is key. Local and national pitch competitions offer just that by allowing startups to present their visions to panels of investors.

While the money rewards tend to be modest (usually under 50k), it comes with no strings attached. Pitch events also provide publicity, expert feedback, and connections to helpful mentors. If you are a student founder, leverage your university entreprenurial ecosystem as much as possible.

Government and Nonprofit Grants

An overlooked funding source resides in government and nonprofit grants targeting certain sectors. For example, agencies like the NSF and NIH fund science and health innovation research.

For example, Blackstone Launchpad has a fellowhsip program that provides thousands of dollars in grants, mentorships, resources and an extensive network to entrepreneurs. Be creative in investigating what public/private grants apply to your startup’s focus area or demographic.

Angel Investor Networks

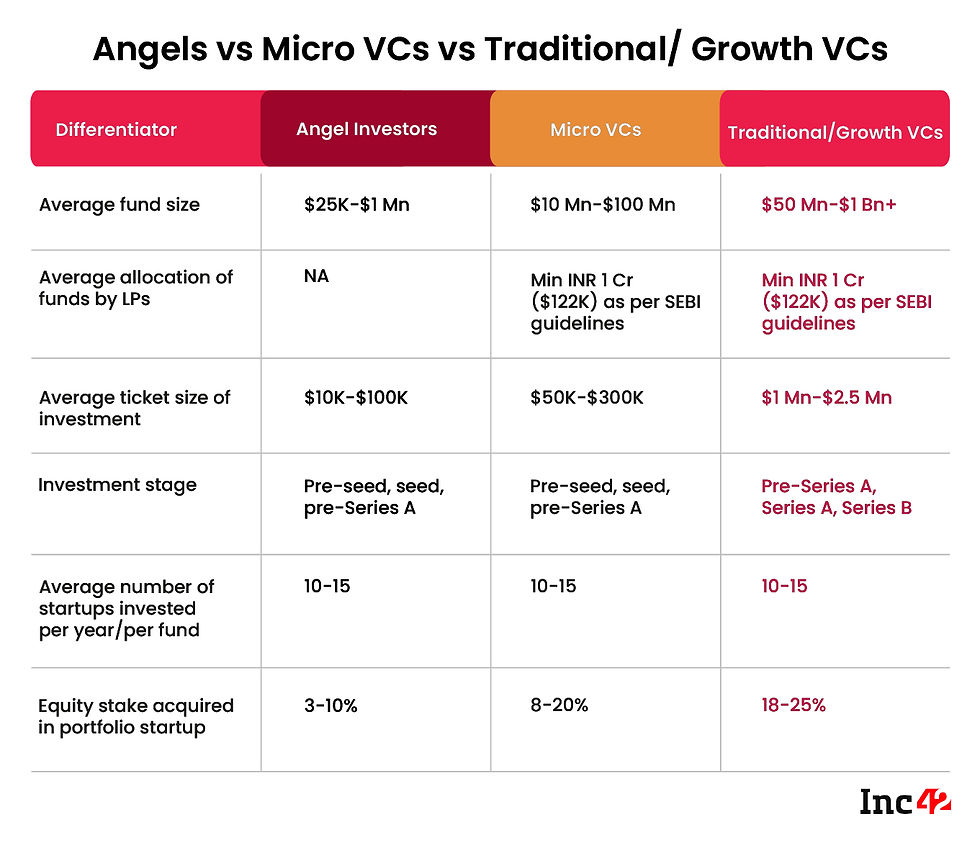

Beyond friends and family, expanding your investor search to local angel groups and high-net-worth networks provides another seed funding source. The key is finding angels who bring strategic value beyond just capital, through mentorship and relevant connections.

Set clear expectations upfront on vision, governance, returns, and exit strategy. Diligence ensures aligned values and prevents issues down the line.

Micro VCs

While big-name venture capital firms require hard metrics, traction, and teams to back startups, Micro VCs specialize in early-stage investing. They embrace riskier bets with higher potential rewards.

What Micro VCs often lack in brand prestige, they counter with hands-on support in operations, scaling, designer referrals, and leveraging additional investment. Don’t overlook them.

Revenue-Based Finance Loans

An interesting alternative funding model that’s emerged recently is revenue-based financing loans. These provide credit line access akin to working capital loans that flex according to your monthly revenues.

As your startup grows, loan payments scale dynamically along with revenue gains. This reduces the chance of default if projecting hockey stick growth.

Creative Grassroots Fundraising

Finally, don’t ignore tried and true grassroots options. Crowdfunding through donation sites offers the chance to validate product demand. Reward-based campaigns keep contributors engaged in the long run too.

Consider pre-selling new products at a discount price. It funds inventory while instantly validating the market with real orders. Get creative embracing your own network’s passions and talents.

The Breakthrough Combo

Rather than shoehorn your startup finances into just personal funds, leverage a creative combination of these capital sources. Blending 1-2 alternative funding hacks matches the strength and stage each option brings.

Securing diverse, dynamic financing unlocks flexibility to nurture a stronger, more resilient early-stage startup built for the long haul toward profitability. Give these options a shot to accelerate your entrepreneurial dreams!

コメント